|

By Ken Adamo, DAT Solutions

At a time when shippers and other transportation buyers are feeling uncertainty in their businesses, an increase in truckload freight rates should be no surprise.

With supply chains strained by the impact of the COVID-19 coronavirus, spot truckload rates has moved higher in March as a surge in volume from replenishment activities continues to drive up demand.

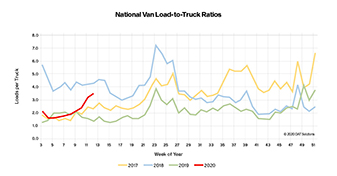

The national average van load-to-truck ratio during the week of March 16-22 was 3.5, up from 3.2 the previous week. That's the eighth straight week of rising ratios. More dramatically, the average ratio has more than doubled (up 150%) since the same week in 2019.

Spot rate trends follow load-to-truck ratios, which are a dynamic indicator of supply and demand in the truckload freight market. Monitoring the ratios will provide directional guidance.

Rates are up 12%

The average spot line-haul van rate (no fuel surcharge) has increased 12% from $1.51 per mile on March 1 to $1.70 per mile on March 23. Compared to the same period in 2019, rates are up 10%.

With fuel, the national average van rate was $1.85 per mile during the week ending March 22, 6 cents higher than the February average.

Rates mid-range hauls are especially sensitive to rate increases right now. Any overnight stay for the driver involves safe parking, decent food, and other roadside necessities that are in short supply, so shippers are paying more for van capacity on "tweener" lanes with lengths of haul in the 250- to 600-mile range.

Reefer demand intensifies

Shifts in consumer purchases have a profound impact on demand and rates for temperature-controlled trucks and trailers.

Nationwide shutdowns of schools, restaurants, and other food service venues have focused shippers'

|

The national average van load-to-truck ratio during March 16-22 is more than double year over year, signaling higher truckload rates. Click to view larger.

The national average van load-to-truck ratio during March 16-22 is more than double year over year, signaling higher truckload rates. Click to view larger.

and carriers' attention almost entirely on retail grocery outlets, including e-commerce. Further, reefers must be loaded "live" with perishable goods, making delays and disruptions even more costly for the carrier.

In the coming weeks, a new layer of demand will be added to the mix when spring produce harvests begin. Reefer rates can be expected to remain elevated from now through the end of June.

Flatbed spot rates are following normal seasonal patterns, but on the low side. This does not come as a surprise, as it is rare for groceries or general retail merchandise to move on flatbeds. Also, the recent steep drop in oil prices has slowed demand for flatbed equipment in energy-related sectors.

For the latest updates

Typically, volatile conditions are disruptive within a defined geographic area, as in extreme weather events such as blizzards or hurricanes, or for a relatively brief period of time. The COVID-19 response and economic effects have upended entire populations and industries across the planet, with many reciprocal connections.

The unprecedented nature of this situation makes it difficult to provide guidance beyond the very short term. Shippers, carriers, and brokers are strongly advised to refer to current, actionable data in support of transportation pricing decisions now, and to keep a close eye on broader market conditions for additional insight into trends that will emerge in the coming weeks.

Ken Adamo is chief of analytics at DAT Solutions, based in Portland, Ore. DAT operates the industry's largest electronic marketplace for spot truckload freight. dat.com

|