|

By Mark Montague, DAT Solutions

Spring is usually a busy time for truckload freight, and, relatively speaking, 2019 has been no exception.

In March, freight volumes increased 4 percent for vans and 2 percent for refrigerated goods compared to February. Flatbed was the strongest segment of the three, with a 10 percent increase in demand for available trucks.

Year over year, van and reefer volumes were just 2.5 percent and 3.4 percent lower in March—not bad, considering how load-to-truck ratios were at record levels ahead of last year's April 1 enforcement deadline for electronic logging devices. Indeed, flatbed volume in March actually increased 4.8 percent year over year.

With more freight available, you'd expect truckers to be able to charge more.

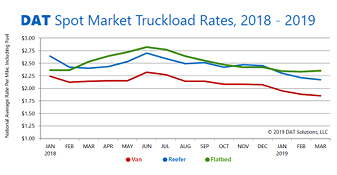

Yet national average spot rates continue to slip. In March, the national average spot van rate fell 3 cents to $1.85 per mile and the reefer rate declined 4 cents to $2.17 per mile compared to February.

Even the arrival of produce season in several southern markets hasn't been enough to boost national averages.

What happened to truckload pricing?

Two things in particular.

Unexpected events, including flooding in the Midwest and a major tank fire in Houston, prevented the typical surge of shipments ahead of the close of Q1. During the first half of April, snow and heavy storms disrupted supply chains from Colorado to the Upper Midwest and beyond.

In some cases, weather can elevate rates on the spot market because shippers will pay more to make sure their freight gets moved. We see this ahead of hurricanes and other big weather systems as shippers and freight brokers boost their spending to

|

While freight volumes are up, weather and more capacity have put a damper on spot truckload rates.

While freight volumes are up, weather and more capacity have put a damper on spot truckload rates.

secure capacity and reposition inventory.

But weather can hurt rates as well. For example, when snow pummeled the Rockies in March, the challenge of getting freight into Denver led to a sharp increase in rates on the van lane from Seattle to Salt Lake City. Then, the surplus of West Coast trucks in Salt Lake City caused rates on the lane from there to Stockton to sharply decline.

This highlights a second factor affecting rates right now: capacity.

Many carriers have invested in new equipment recently and the record numbers of tractors and trailers ordered last year are starting to come into the system now. More still have brought more owner-operators into their mix.

Simply put, there are ample trucks to cover the demand this spring, so rates have not increased as expected.

One segment is bucking the trend: the national average spot flatbed rate increased 2 cents to $2.35 per mile in March, a sign that construction materials, heavy equipment, and freight related to oil and gas markets are starting to move.

We'll talk more about that next time.

Mark Montague is senior industry pricing analyst for DAT Solutions, which operates the DAT® network of load boards and RateView rate-analysis tool. He has applied his expertise to logistics, rates, and routing for more than 30 years. Mark is based in Portland, Ore.

|