|

By Pat Pitz, DAT Solutions

Four months before the federal electronic logging device (ELD) mandate took effect on Dec. 18, 2017, we asked users of DAT load boards how they planned to deal with the new regulation. Most of the respondents were owner-operators and small carriers, and 30% said they would leave the industry rather than use an ELD.

That didn't happen.

While some may have followed through on that threat, the number of active carriers on DAT load boards has grown at a faster rate since the mandate went into place.

What changed?

In December 2017 and early January 2018, the combination of a strong economy, holiday-related freight, rebuilding efforts following hurricanes Harvey and Irma, and uncertainty around ELDs pushed spot truckload rates to new highs. The average rate for spot van freight was $2.24 per mile in January 2018 compared to $1.67 a mile a year earlier.

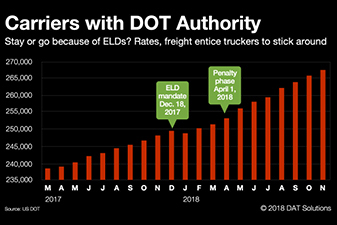

Why would you want to park you truck against the fence when you can be making the best money in years? Indeed, the number of operating authorities increased steadily during 2018.

Shippers and carriers also adjusted to issues with productivity following the ELD mandate.

In some cases, what were previously one-day trips turned into two-day excursions, because ELDs provide less flexibility when recording hours of service. Shippers worked to promote themselves as "shippers of choice," instituting policies to reduce delays and compensate carriers for lost time.

Carriers bracing for less income due to reduced miles because of ELDs discovered that tighter capacity and higher rates made up for the loss of revenue. In June, six months after the mandate took effect, the national average spot van rate hit $2.31/mile, a record high.

Since then, demand, capacity, and rates have

|

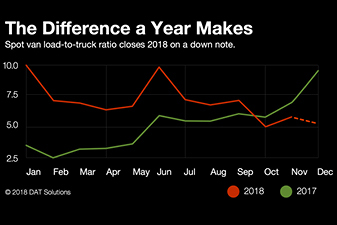

Van load-to-truck ratios indicate that one year after the ELD mandate took effect, shippers and carriers have adjusted.

Van load-to-truck ratios indicate that one year after the ELD mandate took effect, shippers and carriers have adjusted.

Truckers said ELDs would drive them out of the industry. Instead, the number of carriers with DOT authority is peaking.

Truckers said ELDs would drive them out of the industry. Instead, the number of carriers with DOT authority is peaking.

returned to more typical levels.

The van load-to-truck ratio—the number of posted loads on the spot market relative to the number of truck posts—hit a peak of 9.9 in both January and June but has since dropped below where they were at this time last year. The national average van rate was $2.08 per mile for the first three weeks of December, same as the monthly average for both November and October.

Despite the volatility and sense of uncertainty in both the U.S. and global financial markets, the transportation economy continues to signal a strong economy. If it weakens, and spot rates slip, we'll see if some of those truckers who were on the brink of quitting in 2017 actually follow through.

Pat Pitz is a writer and editor covering commercial transportation and technology for DAT Solutions. He is based in Portland, Ore.

|