|

By Mark Montague, DAT Solutions

Spot truckload rates certainly aren't where they were a year ago.

In May, the national average spot van rate of $1.80 per mile was 35 cents below the average for May 2018. The average reefer rate was $2.15 per mile, 38 cents lower than May 2018. The flatbed rate averaged $2.27 per mile, 45 cents lower year over year.

You get the picture.

With weather and factors related to trade disrupting supply chains in April and May, the clock was running out on the customary second-quarter rate rebound.

But things were looking up in June.

Two important categories of truckload van freight—seasonal shipments associated with warmer weather, and inventory in West Coast warehouses—are starting to move. When West Coast goods move in higher quantities by truck, it tightens the truck supply because the cycle time for a truck to complete a round trip is higher. In effect, it removes capacity that would otherwise compete on movements in the eastern half of the country.

Refrigerated freight volumes have increased out of both California and Texas, signs that produce season is on.

During the second week of June, average outbound reefer rates were higher in Sacramento ($2.76/mile), Ontario ($2.80/mile), and Fresno ($2.46/mile)—three of the top four California markets (Los Angeles fell 2 cents to $2.93/mile). And reefer freight volumes were up more than 40% out of Nogales, Ariz., on the Mexico border.

|

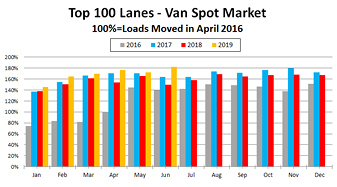

Compared to 2018, freight volumes are stronger in each month of 2019 on the top 100 van lanes. Will July and August continue the trend?

Compared to 2018, freight volumes are stronger in each month of 2019 on the top 100 van lanes. Will July and August continue the trend?

The question now is whether these trends will continue.

Typically, we see a July freight slump in both spot and contract markets which extends to mid-August. This year, with increased tariffs on Chinese goods, the impact may be magnified.

On the other hand, van and reefer freight volumes during the second week of June were each up nearly 20% compared to the previous week. Load-to-truck ratios were higher in Los Angeles, Atlanta, and other high-traffic markets. So current freight conditions give no indication that activity has dropped off in June.

The good news for logistics planners is that contract rates look to be stabilizing during the second half of 2019. There are reasons for optimism and pessimism in terms of freight movements, which leads me to conclude that business will keep rolling at a fairly constant pace in the coming months.

Mark Montague is senior industry pricing analyst for DAT Solutions, which operates the DAT® network of load boards and RateView rate-analysis tool. He has applied his expertise to logistics, rates, and routing for more than 30 years. Mark is based in Portland, Ore.

|