|

By Dean Croke, DAT Solutions

In a typical July in a typical year, spot truckload activity crests early in the month and then gradually descends toward Labor Day when another wave of retail goods and produce washes through North American supply chains.

This year, naturally, defies expectations.

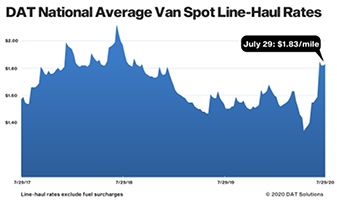

National average dry van spot rates increased during July and hit $1.88 per mile (excluding fuel surcharges) during the week ending July 26. That's 22 cents more than the monthly average in June and on par with the same week in 2018, a period of tight capacity and elevated rates.

Why are spot van rates unseasonably high?

Like virtually everything else in this economy, the coronavirus continues to drive the direction of the freight prices in several important ways.

Shippers face regional imbalances

New coronavirus cases and hospitalizations vary greatly by region, which means the economic impact of COVID-19 differs throughout the country at any given time.

Virus "hot spots" seem to be constantly shifting, affected by local restrictions on travel and business, the migration of agricultural activity, and other factors. Areas where the virus is most prevalent have higher consumption (inbound freight) and lower production (outbound freight), leading to significant imbalances in supply chains.

Contract freight is shifting to the spot market

Citing the challenging logistics of efficiently moving freight from a "closed" economy to one that's more open (and vice versa), contract carriers are being choosy about the loads they take.

While overall truckload freight volumes are lower than in previous years, more freight that would normally move by contract carriers has shifted to the spot market. Currently the number of available load posts on DAT load boards is around 30% higher compared to the same period in 2018.

Shifting consumer demand

Shifting consumer demand creates uncertainty at the lane level as well, with volumes for some commodities surging while others plummet.

The supply side is equally impacted, as manufacturers adapt to new workplace safety requirements. Bloomberg reported that Whirlpool customers are now waiting longer for their dishwashers. CEO Jim Peters reported deliveries that usually take up to two weeks are now out to six months as a direct result of the pandemic. The main reason for the delay is because the company has spaced factory employees farther apart to prevent

|

Click to view larger.

Click to view larger.

spread of the virus, which slows down production lines and reduces capacity.

This is just one of many examples currently impacting supply chains, warehouse capacity, and truckload volumes, and what's clear is it's going to take time for the market to stabilize.

Inventories are rising

Several recent data points suggest inventories are rising faster than sales. The latest Logistics Managers Index showed June inventory levels up by 7.6% month over month after being relatively flat during March, April, and May. Warehouse capacity has been contracting for four months in a row, with June dropping 6% to its lowest level since the index began in early 2018.

The latest manufacturing and sales inventory report published by the Census Bureau showed that the inventory-to-sales ratio improved slightly to 1.51 in May from 1.67 in April. To put this into perspective, the current reading is higher than the peak in both the Great Recession and the previous "freight recession" in 2016, when the inventory-to-sales ratio was 1.48 and 1.43 respectively.

From a freight recovery perspective, high inventory-to-sales ratios translate to lower truckload volumes. Inventory needs a market—and soon, especially if the trend continues where shippers are using slower-moving intermodal containers to supplement stretched warehouse capacity.

The big question for businesses operating on the spot market is whether the recent run of higher rates can be sustained given that overall freight volumes remain depressed year over year. Some commodities (groceries, household goods, building materials, and electronics) have seen volumes increase during the pandemic, but overall shippers are still grappling with inconsistent consumer demand.

Eventually, consumer spending will help sort out the supply chain imbalances. It's hard to know when that will happen, but spot van rates will be a bellwether indicator.

Dean Croke is principal analyst at DAT iQ, the freight data and analytics operation at DAT Solutions. He brings 35 years of experience in the fields of data science, supply chain management, risk management, and human performance. For more information, visit dat.com.

|