|

By Mark Montague, DAT Solutions

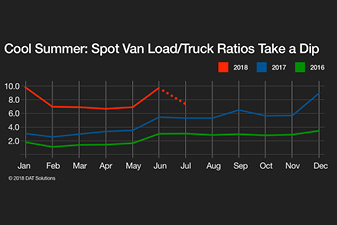

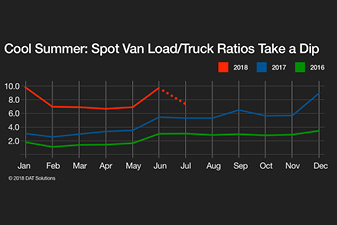

June capped an unprecedented 15-month run of spot market rate increases, likely to turn into the longest sustained period of pricing power for truckers since deregulation in 1980 before it's done.

While contract rates increased by 19 percent for vans compared to June 2017, spot market rates rose by 29 percent during the same period. With rates at record highs and capacity in short supply, shippers have to be asking themselves how much longer this challenging freight environment will last.

They can repeat after me in the inimitable groan of Winnie-the-Pooh's buddy, Eeyore: "Days, Weeks, Months, Years. Who knows?"

Freight prices are hard to predict but moderating factors are already apparent.

First, more truckers are posting their vehicles on the spot market.

The van load-to-truck ratio averaged 9.9 in June, meaning there were 9.9 loads posted on the DAT network of load boards for every truck. The ratio had slipped to 7.3 by the middle of July—still high, but down more than 5% since the start of the month. The flatbed load-to-truck ratio was 48.4, its lowest mark since Dec. 23, 2017, and the refrigerated ratio was 8.9, down from an all-time high of 14.7 on

June 9.

Why is the capacity pressure easing?

One theory is that the van segment is figuring out electronic logging devices (ELDs).

John Seidl, vice president of risk services at Reliance Partners in Chattanooga, Tennessee, and a trucking industry compliance expert, says carriers hat implemented ELDs last year in advance of the

|

tDec. 18, 2017, compliance deadline are gaining back the 4 to 6 percent productivity hit from ELDs by working with shippers on ways to improve operational efficiency.

Another is that shippers and brokers are posted less freight. Overall spot freight volumes have been flat compared to the same time last year.

There will continue to be ongoing issues with a shortage of flatbed equipment to handle record demand in the energy and construction sectors. Here, rising interest rates and trade issues may slow the segment to more manageable levels.

Overall, while there are signs that freight rates and capacity concerns are leveling out, it's hard to see the market tipping quickly in shippers' favor. I believe we're in the midst of what could be the longest period of carrier pricing power in some time, potentially running well into 2019.

But who knows? As Eeyore would say, "It's not much of a tale [tail], but I'm kind of attached to it."

Mark Montague is senior market analyst for DAT Solutions, which operates the DAT® network of load boards and RateView rate-analysis tool. He has applied his expertise to logistics, rates, and routing for more than 35 years. Mark is based in Portland, Ore.

|