|

By Mark Montague, DAT Solutions

The truckload freight market has been a whirlwind of activity lately.

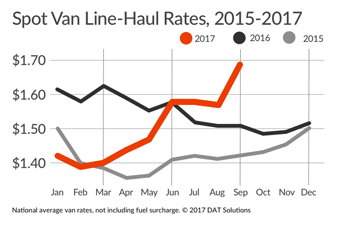

Demand for capacity, already at a premium, pushed spot truckload rates to levels not seen since December 2014. Economic growth and agricultural activity added to the total freight available for all carriers, but hurricane-driven disruption stalled contract hauls and shifted some of that volume to the spot market.

Consider these spot-market milestones:

- In September, van freight activity increased 15 percent compared to August and 80 percent year over year. There were 6.6 available van loads for every available truck on the spot market, the highest monthly average in at least eight years.

- The national average spot van rate was $1.97 per mile in September including a fuel surcharge. That's 19 cents higher than in August and 35 cents higher than in September 2016. During the first week in October, the national average spot van rate hit $2.09 per mile. It hasn't been that high since late 2014.

- Bolstered by robust harvests in Upper Midwest and Pacific Northwest, plus late harvests in California, refrigerated truckload freight activity in September increased 3.8 percent compared to August and was 70 percent higher year over year. Spot reefer rates, predictably, went up: at $2.23 per mile, the national average spot reefer freight rate was 15 cents higher compared to August and 32 cents higher year over year.

- We experienced the highest national reefer rate in nearly three years during the first week in October, when it hit $2.37 per mile. That same week the load-to-truck ratio was 12.4 refrigerated loads for every available truck.

- Flatbed freight activity in September increased 3.2 percent compared to August as recovery and rebuilding efforts picked up in the Southeast. Flatbed freight volume typically declines this time of year. The flatbed rate was up 8 cents to $2.26 per mile and topped out at $2.33 per mile to start October.

|

The last week in September also brought record demand for flatbed capacity, sending the load-to-truck ratio soaring to 50.2 loads per truck—its highest mark in years.

December could be busy

The big question is, will this continue?

I'd emphatically state that December will be busy. Strong economic drivers, especially retail ensure that will be the case. December used to be a slow month for freight, as merchandise had to be on store shelves by Black Friday. The rise of e-commerce means freight is moving far later in December and even through part of January, to service gift card redemption.

This year, there will be a new pressure point in December: compliance with the federal electronic logging device mandate takes effect on Dec. 18. Many large carriers have adopted ELDs in place of paper logs as a record of driver duty status but it's hard to predict how enforcement of the rule will affect the productivity of smaller fleets and owner-operators or further tighten capacity.

For now, demand remains hot. Based on patterns from the last three years, expect higher demand for truckload capacity to continue.

Mark Montague is industry rate analyst for DAT Solutions, which operates the DAT® network of load boards and RateView rate-analysis tool. He has applied his expertise to logistics, rates, and routing for more than 30 years. Mark is based in Portland, Ore. For information, visit www.dat.com.

|